बड़ी ख़बर

ख़बरें उत्तराखंड से

ख़बरें उत्तर प्रदेश से

देश

राज्य

दुनिया

UN: यूएन में सुरक्षा परिषद की व्यवस्था पर भारत ने फिर उठाए सवाल, कहा-...

भारत ने एक बार फिर संयुक्त राष्ट्र की बैठक के दौरान सुरक्षा परिषद की व्यवस्था पर सवाल उठाए और इसमें बदलाव की मांग की।...

Donald Trump: दुष्कर्म के आरोपों को डोनाल्ड ट्रंप ने नकारा, बोले- ये घटिया और...

अमेरिका के पूर्व राष्ट्रपति डोनाल्ड ट्रंप इन दिनों लेखिका ई. जीन कैरोल द्वारा लगाए गए दुष्कर्म के आरोपों के मामले में मुकदमे का सामना...

War: पुतिन पर हमले के आरोपों के बीच रूस ने तेज किए यूक्रेन पर...

यूक्रेन पर रूसी राष्ट्रपति व्लादिमीर पुतिन की हत्या की कोशिश के आरोप लगाने के बाद रूस की सेना ने बुधवार को कीव से लेकर...

व्यापार

South Korea: निर्मला सीतारमण बोलीं- क्षेत्रीय विकास के लिए बदलाव के रुख वाले मजबूत...

वित्त मंत्री निर्मला सीतारमण ने एक मजबूत एशियाई विकास बैंक (एडीबी) की जरूरत पर जोर दिया है। सीतारमण ने गुरुवार को कहा कि हमें...

Go First Crisis: गो फर्स्ट ने एनसीएलटी से मांगी राहत, DGCA की कार्रवाई रोकने...

संकटग्रस्त गो फर्स्ट ने राष्ट्रीय कंपनी विधि न्यायाधिकरण (एनसीएलटी) से कुछ चीजों के लिए अंतरिम निर्देश देने की मांग की है। गो फर्स्ट ने...

Investment: खुदरा निवेशकों का औसत निवेश घटकर 68321 रुपये; 675 उत्पादों के लिए गुणवत्ता...

म्यूचुअल फंड में खुदरा निवेशकों का औसत निवेश मार्च में तीन फीसदी घटकर 68,321 रुपये रह गया। एसोसिएशन ऑफ म्यूचुअल फंड्स इन इंडिया (एम्फी)...

खेल

Kohli vs Gambhir: बार-बार क्यों गुस्सा करते हैं विराट कोहली और गौतम गंभीर? खिलाड़ियों...

लखनऊ सुपर जाएंट्स (LSG) और रॉयल चैलेंजर्स बैंगलोर (RCB) के बीच सोमवार को हुए मैच के दौरान खूब हंगामा हुआ। RCB के विराट कोहली...

Virat Kohli Real Boss: गंभीर से विवाद के बाद विराट कोहली ने बताया- कौन...

रॉयल चैलेंजर्स बैंगलोर के स्टार प्लेयर विराट कोहली पिछले कुछ दिनों से सुर्खियों में बने हुए हैं। लखनऊ सुपर जाएंट्स के खिलाड़ी नवीन उल...

IPL 2023: ‘आखिरी साल है तो भी क्यों…’, धोनी से बार-बार रिटायरमेंट को लेकर...

भारत के पूर्व विस्फोटक ओपनर वीरेंद्र सहवाग चेन्नई सुपर किंग्स (CSK) के कप्तान महेंद्र सिंह धोनी से बार-बार उनके आईपीएल रिटायरमेंट को लेकर सवाल...

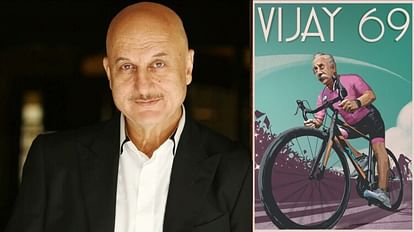

मनोरंजन

ज्योतिष/धर्म

Chandra Grahan 2023: चंद्र ग्रहण कल, देशभर में कहां-कहां दिखाई देगा, जानिए सूतक काल...

Lunar Eclipse 2023 in india Date and Time: सूर्य ग्रहण के बाद साल का पहला चंद्र ग्रहण वैशाख माह की पूर्णिमा तिथि को लगने जा...

Buddha Purnima 2023: 130 साल बाद बुद्ध पूर्णिमा और चंद्र ग्रहण का दुर्लभ संयोग,...

Buddha Purnima 2023: कल यानी 05 मई 2023 को वैशाख माह की पूर्णिमा तिथि है। सनातन धर्म में वैशाख पूर्णिमा का विशेष महत्व होता...

Shadashtak Yog: 10 मई से 1 जुलाई तक मंगल का शनि से षडाष्टक योग,...

वैदिक ज्योतिष में भूमि पुत्र मंगल को अग्नि का कारक कहा गया है इसलिए चन्द्रमा की राशि कर्क में जाकर वो नीच के हो...

टीवी

गैजेट्स

Flipkart बिग सेविंग डेज सेल: Blaupunkt ने लॉन्च किया 40 इंच का एंड्रॉयड स्मार्ट...

जर्मन ब्रांड ने Blaupunkt ने भारतीय बाजार अपने स्मार्ट टीवी की नई सीरीज Sigma लॉन्च की है। Blaupunkt सिग्मा सीरीज के तहत 40 इंच...

Maxima Max Pro Nitro स्मार्टवॉच भारत में लॉन्च, कॉलिंग के साथ इनबिल्ट गेम भी...

घरेलू कंपनी Maxima ने अपनी नई स्मार्टवॉच Maxima Max Pro Nitro को भारतीय बाजार में पेश कर दिया है। Maxima Max Pro Nitro को...

AI के खतरे को लेकर व्हाइट हाउस में बुलाई गई बैठक, गूगल-माइक्रोसॉफ्ट जैसी कंपनियों...

आर्टिफिशियल इंटेलिजेंस (AI) के गॉडफादर कहे जाने वाले जेफ्री हिंटन ने हाल ही में गूगल से इस्तीफा दे दिया है। उन्होंने एआई के विकास...

लाइफस्टाइल

करियर

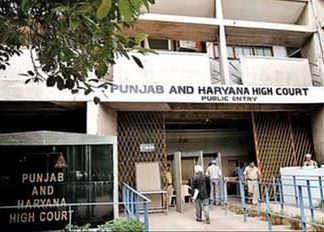

Punjab News: पंजाब के 23 जिलों में RTO के पद बहाल, लोगों को मिलेगी...

पंजाब में नए वाहनों के रजिस्ट्रेशन और ड्राइविंग लाइसेंस बनवाने में अब लोगों को महीनों का इंतजार नहीं करना पड़ेगा। परिवहन विभाग ने एक...

Sarkari Jobs Results Live: 10वीं-12वीं पास के लिए निकलीं नौकरियां, जानें कहां-कैसे करें अप्लाई

Sarkari jobs 2023: सरकारी नौकरी की तैयारी कर रहे हाईस्कूल-इंटर पास युवाओं के पास सुनहरा अवसर है। कई विभागों में नौकरियां हैं। जहां आवेदन...

UPSC CDS 1 Result 2023: जल्द घोषित यूपीएससी सीडीएस 1 का रिजल्ट होगा, जानें...

CDS 1 Result 2023 Soon: संयुक्त रक्षा सेवा (सीडीएस) लिखित परीक्षा का परिणाम जल्द ही जारी होने वाला है। एक बार नतीजे आने के...

एक नज़र इधर भी

Aliens World: मिल गया ‘एलियंस की दुनिया’ का रास्ता! शोध से वैज्ञानिकों के उड़े...

Aliens World: धरती पर कई रहस्यमयी जगहें मौजूद हैं, जिनके बारे में वैज्ञानिकों को भी जानकार नहीं है। अभी तक एलियंस के बारे में...

Elephant Video: हाथी को केले का लालच देना पड़ा भारी, नाराज गजराज ने लड़की...

Elephant Viral Video: जानवरों के वीडियो से इंटरनेट भरा पड़ा है। सोशल मीडिया पर अक्सर जानवर और इंसान के बीच के प्यार का वीडियो...

Alien News: इंसान से बात करना चाहते हैं एलियंस? अंतरिक्ष से आ रही रहस्यमयी...

Alien News: क्या ब्रह्मांड में एलियंस हैं? अगर हैं, तो वो आखिर रहते कहां हैं? सालों से वैज्ञानिक इसका पता लगाने की कोशिश कर...